Parabolic valuation works like Logarithmic valuation, but with a different formula. Use this valuation if you want to bid more aggressively for a certain amount of bandwidth, but progressively less aggressively for amounts above and below that amount. The Parabolic valuation works such that the maximum cost offered for bandwidth occurs at a mid-point of quantity, rather than at a maximum specified quantity.

Below is the Parabolic valuation in the Desktop interface.

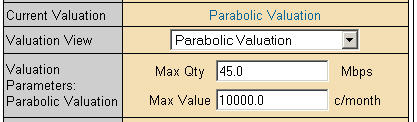

Below is the Parabolic valuation in the Express interface.

The Parabolic valuation applies a formula that corresponds to a curve on a graph. Setting the most bandwidth you could possibly want (maximum quantity, “Qty”) and a value you place on bandwidth (maximum value “Value”) creates a curve. The agent bids based on the relationship of that curve to a third factor, the market rate. The agent reacts based on where the market rate intersects the curve on the graph.

You might want to set the maximum quantity based on one of two possible criteria:

Set Qty to correspond to the greatest amount of bandwidth you would consider obtaining. Note that your agent’s bid is zero at this point, so it is impossible for you to receive exactly this amount.

Set the maximum quantity to place the peak cost bid at a desired quantity. The peak cost bid will be offered at 50% of the maximum quantity you specify. For example, if you wanted to bid most aggressively at 20 Mbps, you would set the maximum quantity to 20/0.5 = 40 Mbps.

The maximum out-of-pocket cost will be 50% of the value you set, as indicated by the graph. Continuing the previous example, if you are willing to pay up to $200 per Mbps (per month) for the 20 Mbps you desire, this is a total cost of $4,000 per month. The value you set is $4,000/0.5 = $8,000.

Aside from the slight differences in “peak aggressiveness” quantity, the Parabolic valuation is much less aggressive than the Logarithmic valuation when bidding for very low units of bandwidth.